Minnesota Withholding Tax Tables 2025. The amount of minnesota withholding tax is using tax tables prepared and distributed by the department of revenue. Find your pretax deductions, including 401k, flexible.

The minnesota tax calculator includes tax. You then send this money as deposits to the minnesota department of revenue and file withholding tax returns.

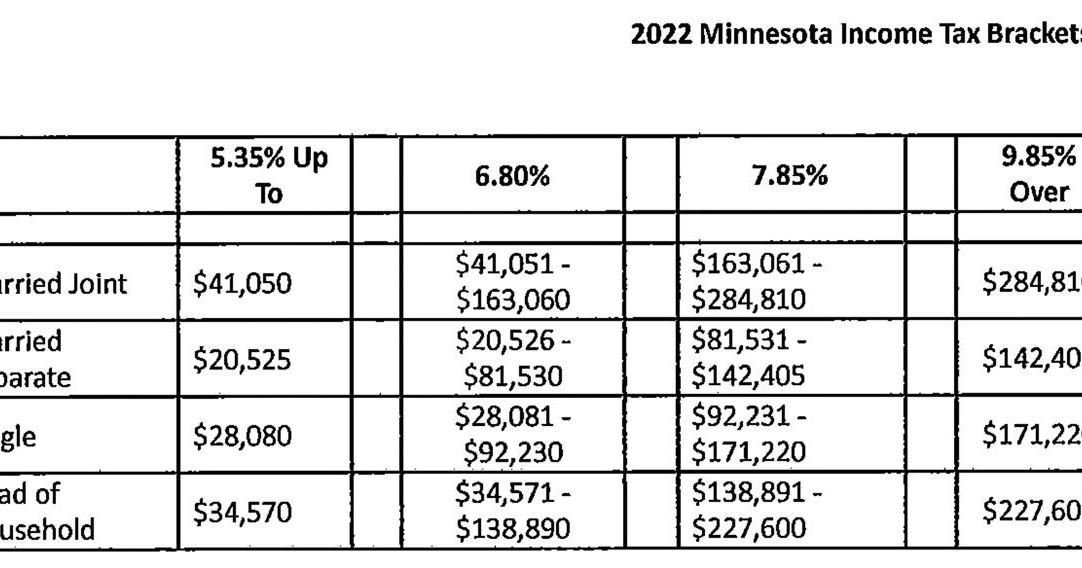

Irs New Tax Brackets 2025 Elene Hedvige, This page has the latest minnesota brackets and tax rates, plus a minnesota income tax calculator. The income tax withholding formula for the state of minnesota includes the following changes:

Minnesota tax brackets, standard deduction and dependent exemption amounts for 2025, Minnesota’s withholding methods were updated for 2025, while changes to the state withholding certificate for pensions were made earlier in 2025, the state revenue. When your income jumps to a higher tax bracket, you don't pay the higher rate on your.

Tax rates for the 2025 year of assessment Just One Lap, The amount of minnesota withholding tax is using tax tables prepared and distributed by the department of revenue. Minnesota's 2025 income tax ranges from 5.35% to 9.85%.

Federal Withholding Tables 2025 Federal Tax, The income tax withholding formula for the state of minnesota includes the following changes: The annual amount per exemption has changed from.

Mn Tax Withholding Tables 2025 Merla Stephie, We recommend that you use the new payroll deductions tables in this guide for withholding starting with the first payroll in january 2025. The minnesota department of revenue jan.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, The salary tax calculator for minnesota income tax calculations. Stay informed about tax regulations and calculations in minnesota in 2025.

Federal Tax Withholding 2025 Kaile Marilee, How to calculate 2025 minnesota state income tax by using state income tax table. Second additional cpp contributions (cpp2)

Minnesota State Withholding Federal Withholding Tables 2025, For tax year 2025, the state’s individual income tax. Minnesota’s withholding methods were updated for 2025, while changes to the state withholding certificate for pensions were made earlier in 2025, the state revenue.

Revised Withholding Tax Table Bureau of Internal Revenue, Second additional cpp contributions (cpp2) The salary tax calculator for minnesota income tax calculations.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Tax tables in january 2025, so this is the latest version of withholding. When your income jumps to a higher tax bracket, you don't pay the higher rate on your.

You then send this money as deposits to the minnesota department of revenue and file withholding tax returns.

Minnesota withholding tax is state income tax you as an employer take out of your employees’ wages.